The Rise of Low Code in Insurance

The Evolution of Low Code in the Insurance Sector

In today's fast-paced digital world, the insurance industry is witnessing a significant transformation with the adoption of low code solutions. The need for innovative approaches to maintain competitiveness and efficiency has never been more apparent. Low code platforms, which allow developers to build applications with minimal hand-coding, have become game-changers in this domain. Insurance companies, traditionally known for their reliance on complex, custom-built software, are now turning to low code to accelerate their digital transformation. This shift is driven by the demand for faster implementation times, reduced costs, and improved agility in responding to market changes. The rise of low code in insurance has not only streamlined operations but also enhanced the ability to offer tailored solutions that meet evolving customer needs. The flexibility of low code environments allows insurers to quickly adapt and develop tools that bolster their service offerings. From enhancing communication channels to automating routine tasks, the potential applications are vast and varied. As insurers continue to embrace these platforms, they are better equipped to compete against agile fintech startups and tech-driven competitors. Ultimately, capturing the myriad benefits of low code technology enables insurance companies to overcome the challenges of their legacy systems, provide exceptional customer experiences, and streamline processes, as discussed in upcoming sections. For those interested in exploring further, this future perspective on low code databases offers additional insights into how these solutions are reshaping industries, including insurance.Streamlining Claims Processing

Transforming the Claims Handling Process

In the fast-paced world of insurance, the ability to quickly and effectively process claims is paramount. Leveraging low code solutions offers a transformative opportunity for insurers to streamline their claims processing with unprecedented efficiency. Low code platforms enable insurers to automate and digitize their claims processes, reducing the time and effort required to manage each claim. By employing low code technology, insurance companies can develop bespoke applications that cater specifically to their unique claims workflows without the need for extensive coding. This not only accelerates the claims lifecycle but also reduces the likelihood of human error, ensuring more accurate and consistent outcomes for both the company and the claimant. Moreover, low code platforms allow for seamless integration with other digital tools and systems across the insurance ecosystem, thereby fostering a more cohesive and connected approach to claims processing. This integration facilitates real-time data exchange, enabling insurers to make quicker, more informed decisions, which ultimately enhances customer satisfaction. For an in-depth look into how low code platforms are revolutionizing the insurance sector, consider exploring the potential of frameworks like Outsystems, which are at the forefront of this technological shift. These advancements promise not only to speed up operations but also to redefine the way the industry processes claims, setting new standards for efficiency and reliability in the insurance landscape.Enhancing Customer Experience with Digital Solutions

Transforming the Customer Journey through Technology

In an increasingly digital world, the insurance sector is undergoing significant shifts as it embraces low code technology to redefine the customer experience. This transformation is not merely cosmetic; it represents a fundamental change in how insurers address the evolving expectations and needs of their clientele. This modernization complements the prior advancements made in claims processing and further disrupts the traditional landscape. Low code platforms empower insurance companies to quickly develop and deploy digital solutions that attract and retain customers. These platforms enable insurers to create intuitive, tailored online portals and mobile apps that provide seamless, user-friendly interactions. With personalization at the core, customers find their experiences enhanced as they receive more relevant suggestions and faster service. This results in higher satisfaction levels, which ultimately leads to increased customer loyalty. The integration of low code solutions also allows for real-time communication, making it easier for customers to engage with their policies. Chatbots and automated messaging are prime examples of low code applications that provide instant support, answering queries without delay. This immediacy of service reduces frustration for customers, who increasingly demand quick resolutions in their digital interactions. Moreover, low code platforms facilitate the incorporation of advanced features like AI-driven analytics and predictive modeling. These technologies can anticipate customer needs, offering proactive solutions before issues even arise. Such predictive capabilities can significantly elevate the digital experience, as customers feel valued and understood by their insurers—fostering a stronger connection between the consumer and the company. In harnessing these digital solutions, insurance firms are untangling themselves from the limitations of legacy systems, which have traditionally hindered innovation. As insurers continue to explore future possibilities and trends in low code insurance, they are setting new benchmarks in customer-centric service. For further insights into digital transformations in other sectors and how choosing the right headless CMS can revolutionize digital presence, you may visit this comprehensive comparison here.Overcoming Legacy Systems

Breaking Free from Legacy Shackles

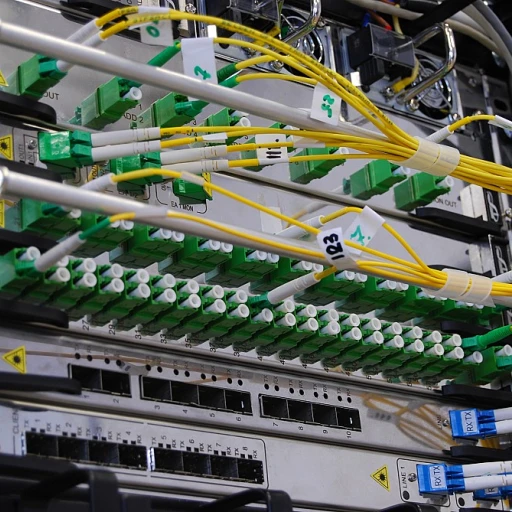

One of the most significant challenges facing the insurance industry today is the reliance on outdated, cumbersome legacy systems. These systems, often rooted in technology that is decades old, pose numerous obstacles to efficient operation, particularly in an era where agility and rapid response are paramount. Low code platforms emerge as a promising solution to break free from these legacy shackles. These platforms enable insurers to swiftly develop and deploy innovative applications that can interoperate with existing systems, thus preserving valuable data while enhancing functionalities. The drag-and-drop features of low code significantly reduce development time, allowing companies to modernize their infrastructures without the daunting task of replacing them entirely. Insurance companies leveraging low code can, therefore, transition their old systems to modern architectures seamlessly. This transformation not only leads to improved operational efficiencies but also lays the groundwork for integrating advanced technologies such as AI and machine learning. These enhancements can elevate everything from customer service to risk assessment, providing insurers with a competitive edge. Moreover, the ability to adapt and scale rapidly in response to market changes is crucial. With low code solutions, insurers can effectively keep pace with evolving customer expectations and regulatory demands, ensuring compliance and retaining customer trust. In closing, overcoming legacy systems with low code is not merely about technological transition—it embodies a strategic evolution towards a future-ready insurance industry. Insurers can now focus on innovation and growth rather than being bogged down by the inefficiencies of the past.Case Studies: Success Stories from the Field

Real-World Examples of Low Code Success in Insurance

As the insurance industry increasingly embraces low code solutions, several companies have emerged as pioneers, demonstrating the transformative power of this technology. These success stories provide a glimpse into how low code platforms are reshaping the landscape, offering lessons and insights for other insurers looking to innovate.

One notable example is a leading European insurance firm that faced challenges with its claims processing system. By implementing a low code platform, the company was able to streamline its operations significantly, reducing the time taken to process claims by over 40%. This efficiency gain not only improved customer satisfaction but also allowed the firm to allocate resources more effectively, focusing on areas that required human expertise.

Another inspiring case comes from a mid-sized American insurer that sought to enhance its customer experience. By leveraging low code tools, the company developed a suite of digital solutions, including a user-friendly mobile app and an intuitive online portal. These innovations enabled customers to manage their policies and file claims with ease, leading to a 30% increase in customer engagement within the first year.

Furthermore, a large multinational insurer successfully overcame its legacy system challenges by adopting a low code approach. This transition allowed the company to integrate modern functionalities without the need for a complete system overhaul, saving both time and costs. The flexibility of low code platforms enabled the insurer to adapt quickly to market changes and regulatory requirements, maintaining a competitive edge.

These case studies underscore the potential of low code solutions to revolutionize the insurance industry. As more companies share their success stories, it becomes clear that the future of insurance lies in embracing these innovative technologies to drive efficiency, enhance customer experiences, and overcome legacy challenges.