Software Evolution in Finance

Technological Shift in Financial Tools

The evolution of software in financial services is one of the most dynamic and impactful transformations within the industry. Financial institutions are increasingly recognizing the importance of adapting to these shifts to remain competitive and provide value to their customers. Over the years, software has moved from traditional, standalone applications to sophisticated, integrated platforms capable of handling the complex needs of modern finance.

Emerging technologies like blockchain, artificial intelligence, and machine learning are no longer at the fringes of financial services but are steadily becoming integral to operations. These technologies promise not only enhanced efficiency and reduced costs but also improved decision-making and risk management capabilities.

Evolving Customer Expectations

The modern financial landscape is characterized by rapidly changing consumer expectations. Customers now demand seamless, personalized, and real-time interactions with their financial service providers. This demand is driving the development of software that can deliver such experiences. Financial software evolution is increasingly focused on user experience, with institutions investing heavily in platforms that offer simplified interfaces, robust functionalities, and accessibility across various devices.

As we see the shift towards Software as a Service (SaaS) models, financial firms are embracing these solutions not just for their cost-effectiveness but also for the flexibility and innovation they provide. For more on how SaaS is shaping the future landscape, explore this piece on

emerging trends in SaaS.

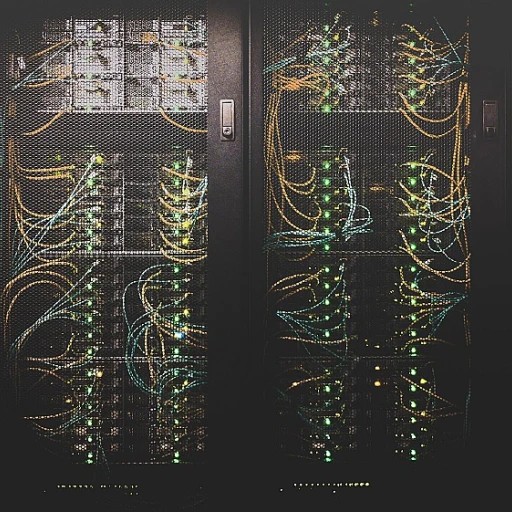

Regulatory Compliance and Security Challenges

With this evolution, there comes an increased focus on regulatory compliance and security within financial software. Regulations such as GDPR and PCI DSS demand that financial institutions maintain high standards of data protection and privacy. As software becomes more integral to financial services, ensuring compliance with these regulations is a top priority.

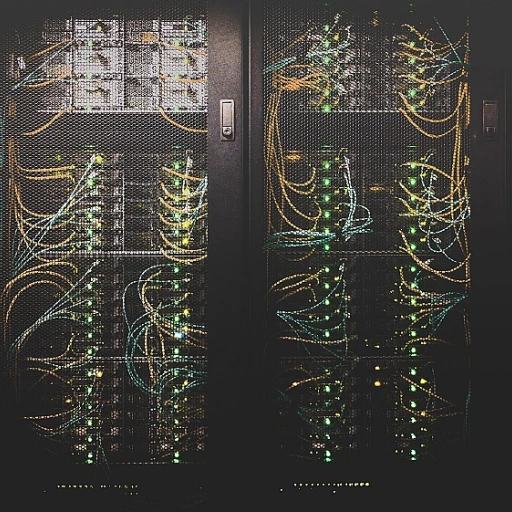

Moreover, cybersecurity remains a critical concern. As financial software becomes more sophisticated, so do the threats. Institutions need to employ cutting-edge security measures to protect against breaches and ensure the integrity and confidentiality of sensitive data.

In the coming sections, we will delve deeper into the data-driven nature of financial software and how digital transformation is reshaping financial institutions. The innovations in software development and the role of fintech in the market continue to be pivotal in shaping the future of this industry.

The Role of Data in Financial Software

In today's financial ecosystem, the significance of data cannot be overstated. The role of data in financial software has evolved dramatically, shaping the way institutions operate, interact with clients, and manage risks. With the advent of big data and analytics, financial software is now more data-driven than ever before.

Data as the New Currency

As financial institutions seek to remain competitive, data is increasingly viewed as a valuable asset, akin to a new currency. The capacity to collect, analyze, and leverage vast amounts of data allows these organizations to gain critical insights into market trends, customer behavior, and potential risks. Consequently, data-driven strategies have become a cornerstone of financial software, enabling institutions to create more personalized offerings and improve customer experiences.

Importance of Real-time Analytics

In the fast-paced world of finance, real-time analytics is becoming a crucial component of financial software systems. Institutions must now process huge volumes of data quickly and accurately to meet the demands of instant decision-making and stay ahead of the competition. Real-time analytics allows businesses to monitor transactions, manage risks, and optimize their portfolios more effectively, providing a significant advantage over more traditional methods.

Challenges in Data Management

While the abundance of data provides countless opportunities, it also presents significant challenges in terms of management and security. Financial institutions must navigate issues of data privacy, regulatory compliance, and the potential for cyber threats. This necessitates robust data management solutions and stringent security protocols to protect sensitive information without stifling innovation.

Machine Learning and AI Advancements

The integration of machine learning and artificial intelligence into financial software systems is transforming the way data is utilized. These technologies enable more sophisticated predictive analytics, aiding in everything from credit scoring to fraud detection. As software continues to evolve, the interplay between AI, machine learning, and data in finance is set to further revolutionize the sector, driving more intelligent and automated decision-making processes.

For more insights into how data impacts enterprise software development, don't miss our article on the next chapter in enterprise software.

The Digital Shift: Bridging Tradition and Innovation

The landscape of financial services has always been characterized by rapid technological advancements. As we delve into the digital transformation of financial institutions, it's crucial to understand how traditional banks and other financial entities are integrating new technologies to stay competitive. This transformation involves not just modernizing legacy systems but also adapting to new consumer expectations and regulatory requirements.

Financial institutions are investing heavily in digital platforms to enhance the customer experience. This shift is leading to an increased need for agile software solutions that can seamlessly integrate with existing systems while providing the flexibility to incorporate cutting-edge technologies. With the rise of digital-only banks and fintech competitors, traditional banks are feeling the pressure to innovate continuously.

One significant driver of this digital transformation is the demand for real-time financial services. Customers today expect instant access to their financial information, requiring financial institutions to utilize advanced software solutions that can process transactions and data analysis at lightning speed. Additionally, the integration of artificial intelligence and machine learning into financial software is transforming risk management, fraud detection, and customer service processes, providing a competitive edge to forward-thinking firms.

Another critical aspect of this evolution is the use of data-driven decision-making. As covered in our

detailed exploration of software testing, the role of data in enhancing software reliability and performance is pivotal. This data-centric approach allows financial institutions to offer personalized banking solutions while managing risks more effectively.

By harnessing the potential of innovative software applications, financial organizations can not only improve operational efficiency but also offer unique value propositions to their customers. The integration of tools like Airtable, as discussed in

track resources for paper, can greatly streamline workflows, ensuring that banks remain robust and adaptable to future changes.

The ability to successfully navigate the digital transformation will determine the financial institutions that thrive in the future marketplace, as they balance maintaining trust with embracing innovation. It's a complex yet rewarding journey of bridging traditional foundations with the limitless opportunities of modern technology.

Innovations in Financial Software Development

Innovative Approaches to Financial Software Development

In the ever-evolving landscape of financial services, the development of software solutions is at the forefront of transformative change. As we delve into the nuances of this sector, it becomes evident that innovation is driving the creation of financial tools that are more efficient, secure, and user-focused than ever before.

Today’s financial software development is heavily influenced by several groundbreaking technologies and methodologies. Agile development practices have become standard, allowing financial institutions to quickly adapt to changing market conditions and customer needs. By leveraging these methodologies, companies can achieve a quicker turnaround on product features and enhancements, ultimately improving customer satisfaction.

Moreover, the influence of artificial intelligence and machine learning in financial software cannot be overstated. These technologies enable predictive analytics, which help financial institutions anticipate customer behavior and manage risks more effectively. As a result, financial software is becoming increasingly proactive rather than reactive, offering institutions a critical edge in decision-making processes.

The concept of microservices architecture is also gaining traction within financial software development. By breaking down applications into smaller, manageable components, developers can innovate and update specific areas of software without overhauling entire systems. This flexibility not only facilitates faster deployments but also boosts the reliability and scalability of financial applications.

Furthermore, the integration of blockchain technology into financial software has opened new avenues for innovation. Blockchain’s decentralized nature offers unparalleled security benefits, particularly in transaction processing and record-keeping. This has led to the development of more secure and transparent financial services, which are crucial in building trust with consumers.

As financial institutions continue their journey of digital transformation, it is imperative for them to embrace these innovations in software development. The race is to develop solutions that not only meet current demands but also anticipate future needs. By staying ahead of the curve, financial service providers can ensure they remain competitive in a rapidly changing market.

Innovations in financial software development are shaping a future where technology blends seamlessly with traditional financial services, enhancing accessibility, security, and user experience. The path ahead is paved with opportunities for those willing to innovate and transform with purpose.

Fintech and the Changing Market

Fintech's Rising Influence on Traditional Finance

The fintech revolution has dramatically reshaped the landscape of financial services, challenging traditional institutions with its innovative approach and technology-driven solutions. As financial technology companies continue to grow and evolve, they are changing the way financial services are delivered, increasing competition, and introducing a new level of agility and customer-centricity into the market.

By leveraging advancements in technology, fintech companies are offering streamlined services that eliminate the need for conventional intermediaries. For instance, peer-to-peer lending platforms provide an alternative to traditional banking loans by connecting borrowers directly with lenders. Additionally, digital wallets and mobile payment apps are replacing the need for physical banking transactions, offering users a more convenient, seamless experience.

One of the key aspects of fintech's impact on traditional finance is its ability to harness data in innovative ways. As previously discussed, data plays a crucial role in developing financial software and shaping financial services. Fintech startups often have the advantage of being able to quickly adapt and implement data-driven solutions, which enables them to offer personalized and efficient services that meet the evolving demands of consumers.

The entrance of fintech has also sparked a wave of digital transformation within financial institutions. As discussed earlier, many traditional banks and financial companies are now investing heavily in digital technologies and platforms to streamline operations, enhance customer experiences, and remain competitive. This transformation is driving collaboration between financial institutions and fintech companies, leading to partnerships that benefit both parties by combining the deep expertise and resources of established firms with the agility and innovation of fintech startups.

In conclusion, as we look towards the future, it is clear that the influence of fintech on the financial industry will only continue to grow. By embracing technological advancements, understanding the critical role of data, and pursuing digital transformation initiatives, financial institutions can thrive in this fast-evolving landscape. Fintech is not just a disruptive force – it's an opportunity for the financial sector to reinvent itself and redefine its future direction.

Future Trends in Financial Software

Emerging Directions in Financial Software

As we move forward, several trends are poised to reshape the financial software landscape, integrating new technologies and advancing financial services in unprecedented ways.

Firstly, artificial intelligence (AI) and machine learning applications are rapidly becoming integral components of financial software. Their ability to analyze vast datasets in real-time offers immense potential for product innovation. Financial institutions can leverage these technologies to enhance risk management strategies and develop more personalized financial products and services. Furthermore, AI-driven automation is set to streamline customer interactions, reducing manual processes and improving service efficiency.

Blockchain technology, despite its initial focus on cryptocurrencies, is gaining recognition for its potential to innovate traditional financial systems. Through its decentralized and transparent nature, blockchain offers new avenues for enhancing transaction security and reducing fraud. Financial software that incorporates blockchain can facilitate secure and efficient cross-border transactions, paving the way for more transparent financial operations.

Additionally, cloud computing continues to transform how financial software is developed and deployed. By moving operations to the cloud, financial institutions can achieve greater scalability, flexibility, and cost savings, while ensuring data accessibility and security. The migration to cloud services has also supported more agile development practices, enabling companies to bring innovations to market faster.

Finally, the arrival of open banking initiatives worldwide highlights the industry's shift towards greater interoperability and customer empowerment. Open banking allows consumers to access and share their financial data with third-party providers, driving competition and fostering the creation of innovative financial solutions. Software development in this space is focused on building secure APIs and interfaces that ensure seamless data exchange while protecting consumer privacy.

In summary, the future of financial software promises a wave of technological advancements that hold the potential to revolutionize how financial services are delivered and experienced. Companies that stay ahead by embracing these trends will likely emerge as leaders in the ever-evolving finance sector.

-large-teaser.webp)